Highlights:

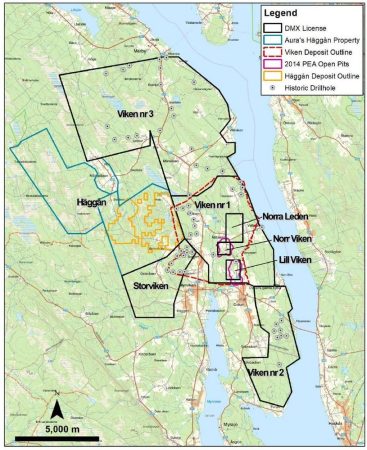

- The four mineral licences to be acquired are in good standing until late-2025, and comprise Norra Leden, Norr Viken, Lill Viken, and Storviken, which has increased the area of the Company’s Viken Property from 9,367 hectares (ha) to 10,812 ha.

- The Norra Leden, Norr Viken, Lill Viken mineral licenses cover the southeast and east areas of the Viken Deposit that remain open to the southeast based on historic drill results.

- The Storviken mineral licence covers the southwest corner of the Viken Deposit that remains open to the south and west based on historic drill results.

- There is currently a moratorium on uranium mining and exploration that was imposed in 2018. The Swedish Government has indicated a positive stance on re-evaluating and lifting the moratorium.

Garrett Ainsworth, CEO of District, commented: “The consolidation of 100% of the Viken Energy Metals Deposit into District is an exciting event for the Company, shareholders, and stakeholders. The Alum Shales in Sweden include critical energy metals for the green energy transition that include uranium, vanadium, nickel, molybdenum, copper, zinc and rare earth elements. Alum Shales also present potential to produce significant potash, which would be of great benefit within the agriculturally dominant Jämtland County.

The timing of this acquisition is right as the price of uranium continues to rise, and political leaders in Sweden continue to announce their positive stance on potentially lifting the moratorium on exploring for, and mining uranium.”

The Purchase Agreement

Pursuant to the Purchase Agreement, District will acquire the Norra Leden, Norr Viken, Lill Viken and Storviken mineral licences upon the following principal terms:

- CDN $50,000 cash payable to the Vendor on closing.

- CDN $50,000 cash payable to the Vendor within 30 days following the moratorium on uranium exploration and mining in Sweden being lifted.

- 1,000,000 District shares to be issued to the Vendor on closing.

- 3,500,0000 District shares to be issued to the Vendor within 30 days following the moratorium on uranium exploration and mining in Sweden being lifted. These District shares will be subject to a voluntary lock-up pursuant to which 500,000 will be released after four months after issuance, 500,000 will be released after six months after issuance, 1,000,000 will be released after twelve months after issuance, 1,000,000 will be released after 18 months after issuance and 500,000 will be released twenty-four months after issuance.

- A 2% net smelter returns (“NSR”) royalty to be granted to the Vendor on closing that can be bought back in its entirety at any time for a value of CDN $8,000,000 where the first 1% NSR royalty may be purchased for CDN $2,000,000.

Closing of the Purchase Agreement remains subject to TSX Venture Exchange (the “TSXV”) approval.

The Uranium-Vanadium Viken Deposit

The Viken Deposit is situated in the province of Jämtland, approximately 570 km northwest of Stockholm, Sweden. Infrastructure is well developed in the area with daily air service, as well as rail and truck freight services. Electrical power and modern communications are also readily available in the area.

The Geological Survey of Sweden (SGU) carried out work on the Alum Shales from 1977 to 1978 and drilled approximately 19 holes within and in the vicinity of the Viken Deposit. In 2005, Continental Precious Minerals Inc. (“CPM”) purchased mineral licences that covered prospective Alum Shales where CPM drilled 26,293 m in 133 holes from 2006 to 2008 to delineate the Viken Deposit.

Further Information ia attached.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()